what percentage of credit card limit to use

Editorial Note: Credit Karma receives compensation from tertiary-party advertisers, simply that doesn't affect our editors' opinions. Our third-party advertisers don't review, corroborate or endorse our editorial content. Information technology's accurate to the all-time of our cognition when posted.

Advertiser Disclosure

We recall information technology's important for y'all to understand how we make money. It's pretty simple, really. The offers for financial products yous see on our platform come from companies who pay us. The coin we brand helps us give y'all access to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may cistron into how and where products appear on our platform (and in what order). But since nosotros generally make coin when you find an offering yous like and go, we try to show you offers we recollect are a good match for y'all. That's why we provide features like your Blessing Odds and savings estimates.

Of class, the offers on our platform don't represent all financial products out there, simply our goal is to show you as many neat options as we tin.

Before we dive into how using your credit bill of fare may affect your credit scores, allow's recap what we mean when we talk about "credit card utilization."

Credit card utilization — or just credit utilization, for short — refers to how much of your available credit you apply at any given fourth dimension.

You can figure out your credit utilization charge per unit by dividing your total credit card balances by your full credit carte limits. The resulting percentage is a component used by most of the credit-scoring models because information technology's often correlated with lending risk.

Most experts recommend keeping your overall credit bill of fare utilization beneath thirty%. Lower credit utilization rates propose to creditors that you can utilise credit responsibly without relying too heavily on it, so a depression credit utilization rate may be correlated with college credit scores.

At present that we've defined our terms, let's await more than closely at how your credit utilization relates to your credit scores.

- Why does my credit card utilization affect my credit scores?

- How does my credit bill of fare utilization touch my credit scores?

- How can I lower my credit card utilization?

Why does my credit menu utilization bear on my credit scores?

Your credit utilization rate is an of import indicator of lending take chances. In the eyes of most lenders, a person who constantly charges all the money they can — hitting or going over their credit limit on a regular footing — is more probable to have difficulty repaying that money.

Conversely, someone who charges smaller amounts may be more than likely to be able to pay off their residual in full each month, and then they correspond a lower chance to the lender.

How does my credit card utilization touch on my credit scores?

At that place are many different credit-scoring models, then it's difficult to calculate exactly how credit utilization will affect your credit scores.

With that said, there'south a strong correlation betwixt a consumer'south credit card utilization charge per unit and their credit scores. Though individual cases may vary, those who keep their utilization percentage low generally have higher scores than those who habitually max out their credit cards.

If you don't want your credit utilization to negatively affect your credit scores, consider your spending habits. Factors such as your credit history and the number of cards in your wallet matter, too.

High utilization on a single credit card could especially hurt your credit scores if you have a short credit history and simply one menu. On the other hand, yous may feel the furnishings less if you accept a long and excellent credit history and spread your utilization across multiple cards.

Though it's an of import factor in computing your credit scores, try not to focus but on this one aspect. Go on the large picture in mind.

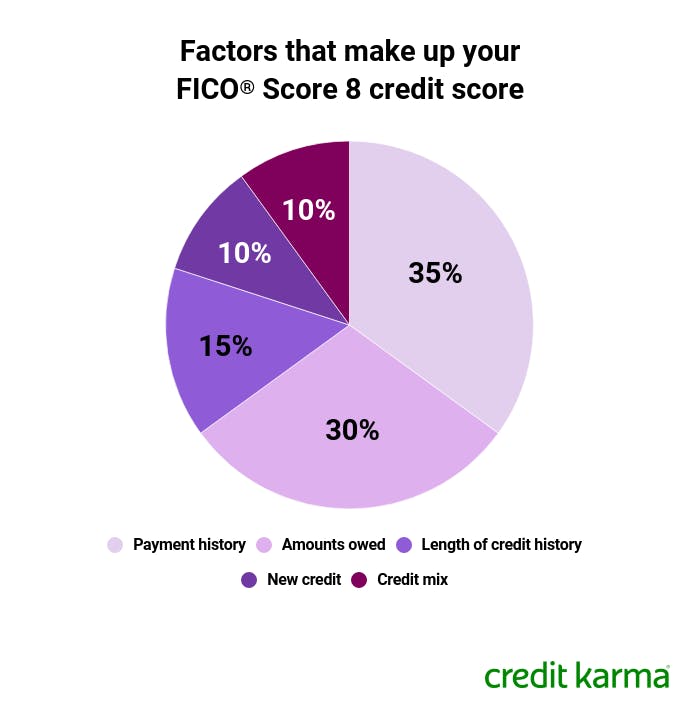

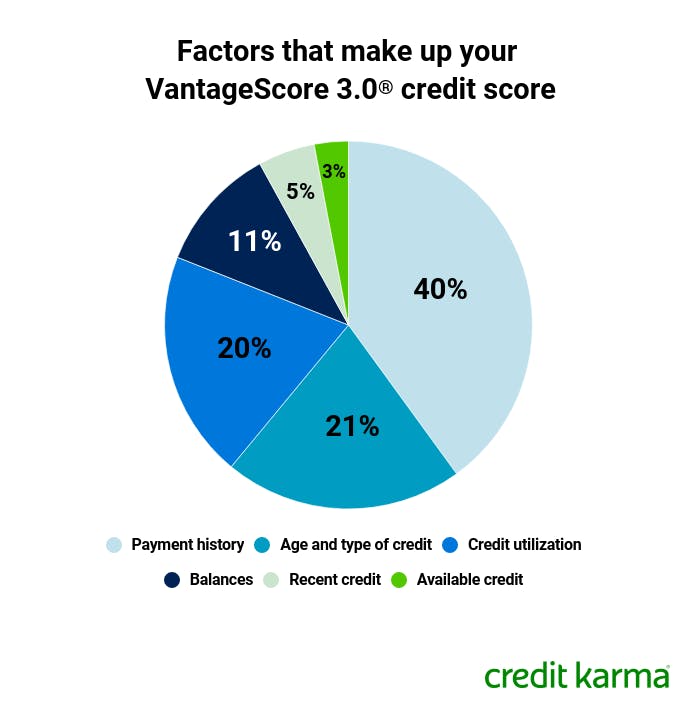

What factors determine my credit scores?

A number of credit-influencing factors are commonly used in calculating your credit scores. These include your credit card utilization, pct of on-time payments and the average age of open credit lines.

The charts below testify what factors make upwardly 2 pop credit score models, the FICO® Score viii credit score and VantageScore 3.0® credit score models. You'll find that credit menu usage, or utilization, is important to both, but not the only cistron.

Prototype: ccupdateutilization-fico

Prototype: ccupdateutilization-fico  Paradigm: ccupdateutilization-vantage

Paradigm: ccupdateutilization-vantage How tin can I lower my credit carte du jour utilization?

Here are 3 tips that may help you lower your credit utilization.

- Make credit card payments more than once a calendar month. This style, your balance never gets too high. Your credit carte issuer volition typically study your credit activity to the credit bureaus once a month. So, if you pay off a portion — or even all — of your credit card bill before that date, you can lower your credit utilization.

- Spread your charges across multiple cards each month. Using multiple cards will effect in multiple accounts of low credit utilization rather than 1 business relationship with high utilization. Just keep in mind that certain credit-scoring models will await at your overall credit utilization and/or the utilization on individual credit cards, so this technique may non always piece of work.

- Increase your available credit. If your income has increased, you've maintained an amazing credit history or yous have little debt, it doesn't hurt to enquire for a credit limit increase. But remember that this can sometimes upshot in a difficult inquiry on your credit. If you don't have excellent credit, you may want to consider opening a secured credit carte and calculation to its security eolith over fourth dimension.

Bottom line

Y'all don't take to conduct a credit card remainder or pay involvement every month to evidence credit carte du jour utilization. Fifty-fifty if yous pay your credit card balances in full every month, just using your card is enough to show activity.

While experts recommend keeping your credit card utilization beneath thirty%, it's important to note that creditors also care about the total dollar corporeality of your available credit. This means that if you have a low credit limit, it's not necessarily a huge deal if your credit card utilization rate is slightly college than recommended.

Source: https://www.creditkarma.com/credit-cards/i/credit-card-utilization-and-your-credit-score

0 Response to "what percentage of credit card limit to use"

Post a Comment